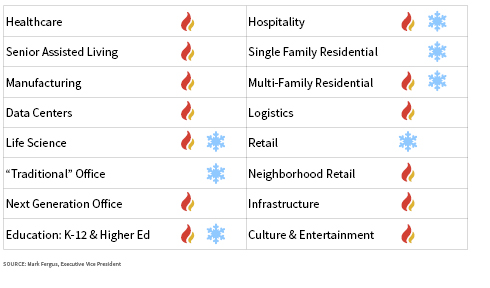

U.S. Construction Volume Trends

U.S. Key Sector Movements

- Manufacturing, which includes semiconductors and electric vehicle components, remains strong as manufacturers look to untangle supply chains by opening facilities in the US.

- Hospitality is being led by high-end luxury developments. These were less impacted by economic conditions than mid-level and other kinds of hospitality projects.

- The life sciences sector has been impacted both by renewed interest in the pharmaceutical industry and the increasing cost of borrowing money.

- Traditional offices face some of the toughest challenges in the entire industry with reduced occupancy, increased costs of finance, and debt maturation. This has led to a drop in property valuation and led to potential conversions. Many companies that went remote in 2020 realized that they still needed places for workers to collaborate. So-called “next-generation offices” is a new category but a quickly growing one.

- The life sciences sector has been impacted both by renewed interest in the pharmaceutical industry and the increasing cost of borrowing money.

- Healthcare has remained stable with regional variations due to changes in labor and materials costs. The year saw growth in long-term care facilities as healthcare becomes redefined to include mental, physical, and spiritual wellbeing.

- Residential construction saw a slowdown in starts primarily due to the cost of finance. Demand remains strong but fluctuations in labor and materials costs heavily impacted the sector. Growth in the residential sector was primarily driven by demand for ground-up, multifamily projects.

– SIGN UP –

Receive a full version of our

construction Market Analysis

each quarter.