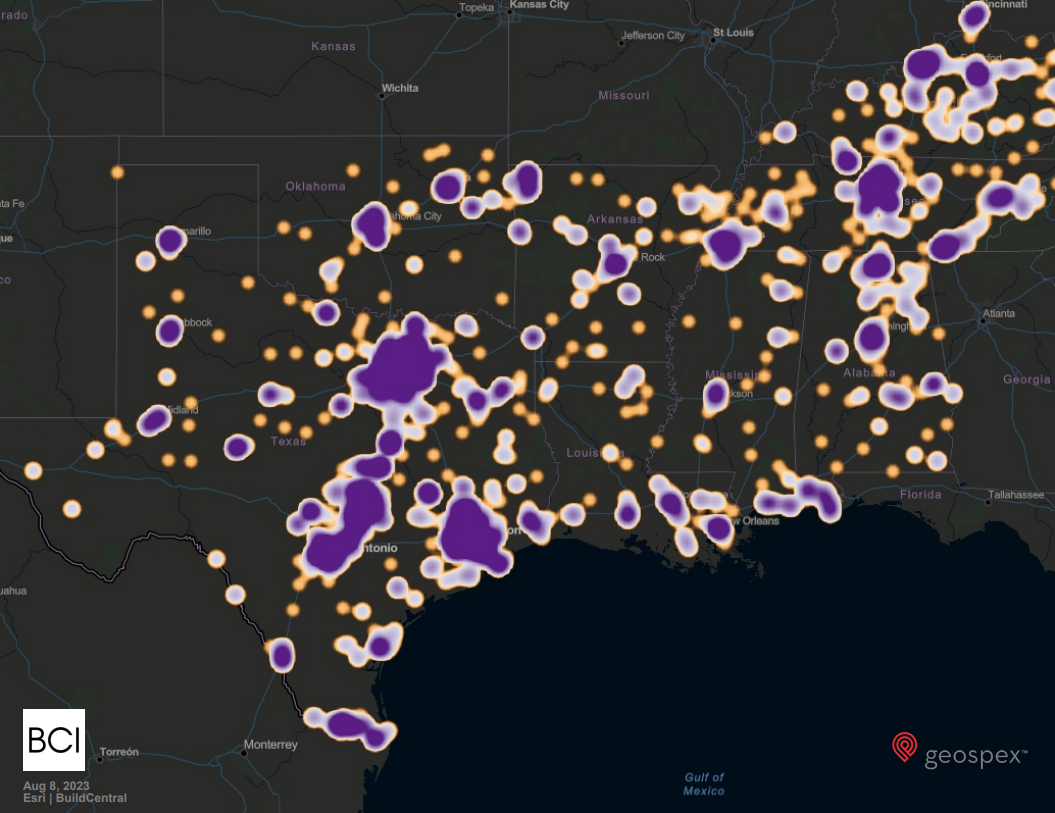

South Central

The South Central region has benefitted immensely from trends in where Americans live and work.

Spending here is dominated by Texas, which is home to the region’s largest cities. Cities like Houston, Dallas, and Austin are all emerging as science and technology hubs to rival Silicon Valley, with spillovers in the biotech and pharmaceutical industries. The region has seen impressive growth over the last few years – in cities like Nashville, Austin, or Houston, it is not uncommon for almost one in five residents to have moved in since 2010. The region has a favorable climate and enough land to accommodate new residents without increasing costs too much, and we see no reason why this growth can’t continue.

The Texas Triangle – the area bounded by Dallas, Houston, and San Antonio – has emerged as one of the country’s largest and most active regions. This was true in our last report and we expect it to be true for years to come. The Samsung Austin Semiconductor project is expected to bring in almost 20,000 jobs across the Austin area and is expected to cost $17 billion over the next 5 years. The key challenge over the coming decade will be keeping these new residents and tying these disparate communities together. The state budget has already increased spending by 10%, with most of it going to new education and healthcare projects. Cities like Dallas, which don’t have mountains or beaches, have invested in fine dining and upscale shopping, hoping to offer residents an outlet for their disposable income.

* Other structures include religious buildings, amusement, government communications, and public recreation projects.

Source: BuildMarket

– SIGN UP –

Receive a full version of our

construction Market Analysis

each quarter.