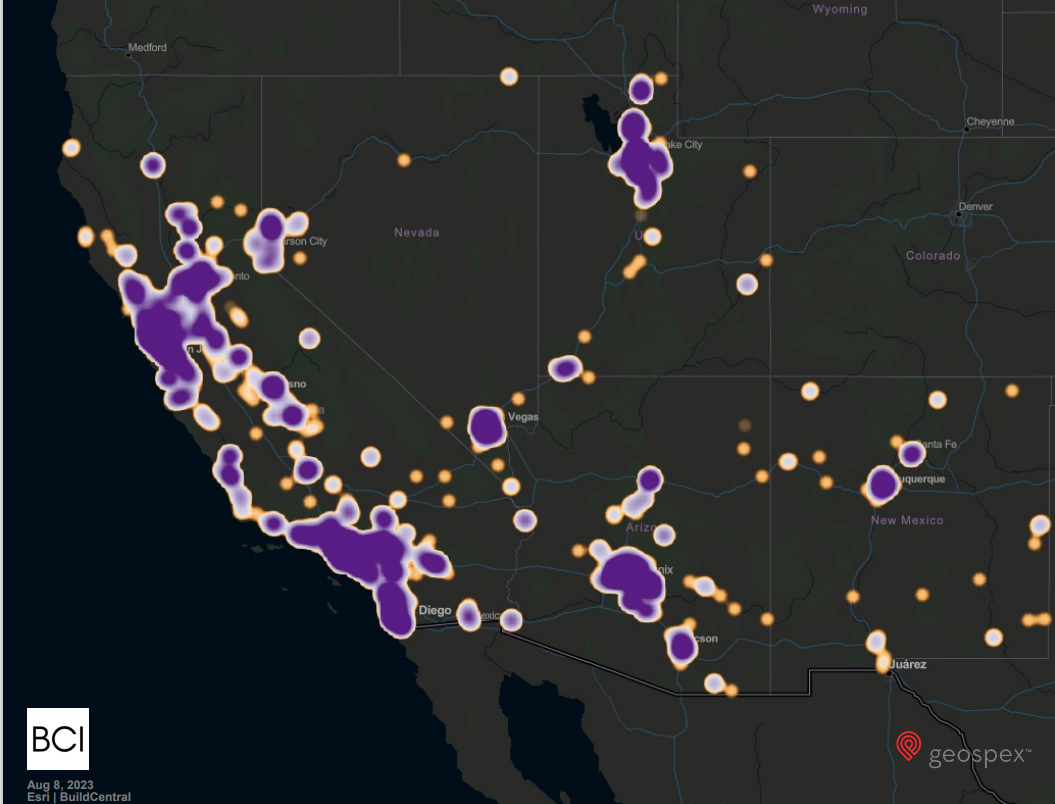

Southwest

California is a clear standout in the Southwest – to the point where it is almost a separate market.

The state, which represents more than half of the region’s population and construction spending, is in the grip of a serious housing shortage. This is particularly acute in the Bay Area but has spilled over into places like Sacramento and San Diego.

Los Angeles in particular must contend with the housing crisis, preparing for the 2028 Olympics, addressing residents’ climate concerns, and tackling an ambitious seismic retrofit program. All buildings built before 1978 must be brought up to modern seismic standards before the end of 2024 or face steep fines. The LA Metro is being extended both to lessen the area’s carbon footprint and provide a way to get around ahead of the 2028 Olympics.

In the non-California part of the region, we expect cities like Phoenix and Las Vegas to benefit from the federal government’s effort to improve high-tech manufacturing in the US. This typically requires specially climate-controlled, low moisture facilities. As Arizona and Nevada are already low-moisture states, building such facilities is comparatively easier here. Taiwan Semiconductor Manufacturing Company (TSMC) and LG are both building facilities in the Phoenix area for exactly this reason. Other companies are beginning to follow suit, as the region already has business-friendly policies and lower-than-average corporate taxes.

* Other structures include religious buildings, amusement, government communications, and public recreation projects.

Source: BuildMarket

– SIGN UP –

Receive a full version of our

construction Market Analysis

each quarter.